Conferences

The Stevens Center FinTech Conferences bring together emerging and established fintech companies, industry leaders, academics, and policymakers, to promote innovation in the financial sector. Stevens Center FinTech Conferences provide in-depth examination of critical areas of financial services such as payments, lending, wealth management, real estate, cryptocurrencies, and (re)insurance. Stay tuned for more information about the Stevens Center’s Inaugural FinTech Conference.

Special Events

The Stevens Center brings to Penn campus the brightest and most innovative minds in financial technology. Lectures, roundtable discussions, and interactive sessions with financial institutions leaders, venture investors, and regulators strengthen our position as global thought leaders in the fintech ecosystem. Dialogue at these special events will help advance our research, curriculum, and thought leadership in fintech.

FinTech Lecture Series

The Stevens Center hosts guest lectures by speakers on the forefront of financial technology. Recent guests include Professor Jeremy Siegel, Bloomberg’s Matt Levine, Scott Bennett of Cravath, Swaine and Moore LLP, John Coates, and Chris Brummer. Learn about upcoming FinTech Lecture Series installments here.

Sign up to receive the Frontier of Finance newsletter!

Past Events

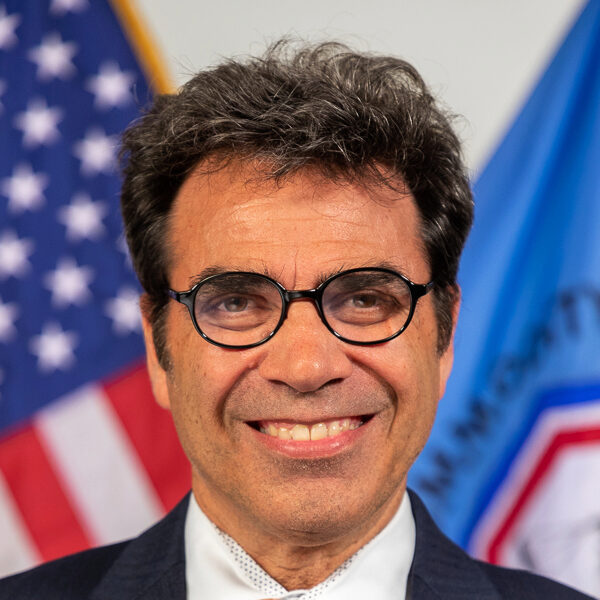

March 18: FinTech Lecture with Heath Tarbert

The Stevens Center for Innovation in Finance welcomed Dr. Heath Tarbert, president of Circle and 14th chairman of the CFTC, back to the Wharton School for an exciting installment of the FinTech Lecture Series.

Dr. Tarbert delivered a short presentation entitled “The Dollar’s Digital Future (and Why It Matters)” on stablecoins, the ongoing digitization of the dollar, regulatory developments, and the impact that these technological advances will have on the economy.

February 7: FinTech Lecture with Jenn Sasso

The Stevens Center for Innovation in Finance and Wharton Cypher Accelerator welcomed Jenn Sasso MoloLamken LLP for the FinTech Lecture Series.

Jenn Sasso is Senior Advisor to Wharton Cypher Accelerator and an alum of the University of Pennsylvania Carey Law School. She is an accomplished trial lawyer and former federal prosecutor who represents individuals and companies in white collar criminal and regulatory matters, as well as high-stakes civil litigation. Sasso represents clients in complex and sensitive investigations by prosecutors and regulatory agencies, including by the U.S. Department of Justice, United States Attorneys’ Offices, the U.S. Securities and Exchange Commission, among others. She has represented individuals and corporate clients across a broad range of industries including banking and private equity, software and manufacturing, and telecommunications and social media.

![JS Headshot[55] A person smiles toward the viewer before a plain white background](https://stevenscenter.wharton.upenn.edu/wp-content/uploads/2025/02/JS-Headshot55.png)

November 1: FinTech Lecture with Hester Peirce

The Stevens Center for Innovation in Finance welcomed Hester Peirce, commissioner of the U.S. Securities and Exchange Commission, for the FinTech Lecture Series.

Hester M. Peirce was sworn in as SEC Commissioner on January 11, 2018. Prior to joining the SEC, Commissioner Peirce conducted research on the regulation of financial markets at the Mercatus Center at George Mason University. She was a Senior Counsel on the U.S. Senate Committee on Banking, Housing, and Urban Affairs, where she advised Ranking Member Richard Shelby and other members of the Committee on securities issues. Commissioner Peirce served as counsel to SEC Commissioner Paul S. Atkins.

![Commissioner Hester Peirce_Headshot_03_10-31-22[79] copy SEC Commissioner Hester Peirce](https://stevenscenter.wharton.upenn.edu/wp-content/uploads/2024/10/Commissioner-Hester-Peirce_Headshot_03_10-31-2279-copy.png)

October 11: FinTech Lecture with Callum Sproule

The Stevens Center for Innovation in Finance welcomed Callum Sproule, corporate associate at Cravath, Swaine & Moore LLP, for our next installment of the FinTech Lecture Series.

While Callum Sproule is currently part of the IP practice at Cravath, Swaine & Moore, he also served under the Mergers and Acquisitions and Capital Markets teams. Sproule has advised some of the largest FinTech companies on a broad range of transactional, regulatory, and privacy matters. He was a summer law clerk at the United States District Court for the Southern District of New York and earned his JD from Yale Law School.

September 26: FinTech Lecture with Timothy Massad

The Stevens Center for Innovation in Finance welcomed Timothy Massad, former chairman of the CFTC, to Wharton for the first FinTech Lecture Series installment of the school year.

Timothy Massad is currently a research fellow at the Kennedy School of Government at Harvard University, an adjunct professor of law at Georgetown Law School and a consultant on financial regulatory and fintech issues. He served as Chairman of the U.S. Commodity Futures Trading Commission from 2014-2017.

April 22: PE/VC Club Celebration

The Wharton Private Equity and Venture Capital (PE/VC) club hosted an intimate event at the Fitler Club to celebrate the graduating leaders of the club. Wharton faculty and Stevens Center co-directors David Musto and Dave Erickson were invited as honored guests, and delivered words of inspiration to graduating PE/VC leaders.

View a photo collection from the event here.

April 19: Finiverse Launch Celebration

The Stevens Center for Innovation in Finance hosted this event to honor Finiverse’s teacher and school partners – and celebrate the incredible work of the students that created the Finiverse app.

The Finiverse app, spearheaded by faculty director and Ronald O. Perelman Professor in Finance David Musto helps college-bound students understand the financial implications of higher education. Learn more about Finiverse here.

April 12: Wharton Cypher Accelerator Demo and Innovation Day

The Stevens Center for Innovation in Finance hosted Cypher Accelerator Demo and Innovation Day at the Penn Club of New York.

Emerging startups in Cypher Accelerator’s Dominion Cohort presented their innovative products and connected with the Wharton School’s extensive network during this event. View the Demo Day recap here.

On April 5, the Stevens Center hosted a FinTech Lecture Series installment with Jorge Herrada

The Stevens Center for Innovation in Finance will welcome Jorge Herrada, director of the CFTC’s Office of Technology Innovation, to Wharton for the final FinTech Lecture Series installment of the school year.

Jorge Herrada is the director of the Commodity Futures Trading Commission’s Office of Technology Innovation (the successor to CFTC’s LabCFTC). This office serves as the CFTC’s financial technology innovation hub, driving change and enhancing knowledge through innovation, consulting and collaboration, and education. Jorge completed a detail as the Senior Technology Advisor to the TechLab at the Federal Reserve Board, where he helped to guide the vision and experiments regarding Central Bank Digital Currency. Prior to joining the Federal Reserve Board, Jorge served for four years as the Senior Technology Advisor for LabCFTC, where he focused on innovation, advanced technology, analytics, finance, Distributed Ledger Technology (DLT), and cryptocurrencies.

On March 22, the Stevens Center hosted a FinTech Lecture Series installment with Sanjeev Bhasker

Sanjeev Bhasker serves as U.S. Digital Currency Counsel with the US Department of Justice’s Digital Currency Initiative, providing legal guidance and support to investigators, prosecutors, and government agencies on cryptocurrency prosecutions, seizures, and forfeitures. He previously served as an Assistant U.S. Attorney, providing trial and appellate litigation throughout the United States. During this exciting presentation, Sanjeev discussed anti-money laundering and the lawsuits surrounding Sam Bankman Fried of FTX, and Binance.

February 9-10: Wharton Latin American Conference

The Wharton Latin American Conference is the world’s largest LATAM conference organized by MBA students. The conference’s mission is to establish an open and multicultural forum to generate and discuss ideas about the future of Latin America, debate key business opportunities and challenges of our region, and generate a concrete path forward toward economic development, social equality, and political stability.

David Musto, faculty director of the Stevens Center, moderated the panel, “Connecting the Americas: Exploring Nearshoring for the US Market in Latin America.” View the panel recap here.

On January 24, the Stevens Center hosted a FinTech Lecture Series installment with Heath Tarbert

Heath Tarbert is chief legal officer and head of corporate affairs at Circle, a global financial technology firm that enables businesses of all sizes to harness the power of stable coins and public blockchains for payments and commerce. Prior to joining Circle, Dr. Tarbert was chief legal officer of Citadel Securities, where he was responsible for the firm’s global legal, compliance, surveillance, and regulatory affairs functions.

On October 17-18, Finance at Wharton hosted the inaugural Future of Finance Forum.

During the Future of Finance Forum, the Wharton School gathered leading thinkers in academia, practice, and government for the inaugural Future of Finance Forum on October 17-18, 2023. Roundtable sessions and fireside chats explored the most pressing current issues in finance under the theme, “Paradigm Shift: Powering with Innovation & Financial Technology.” View a recap of the Future of Finance Forum here.

On November 9, Scott Bennett (Cravath, Swaine, and Moore LLP) Presented “Are Digital Assets ‘Securities’ and Why does it Matter?”

Scott Bennett primarily focuses his practice on representing issuers and investment banking firms in connection with public and private offerings of securities, other financing transactions and general corporate matters. Mr. Bennett advises clients across a broad range of industries encompassing traditional areas and emerging technologies. He has notable experience counseling early‑stage and venture capital‑backed companies in the technology, fintech and crypto, shipping and renewables space.

On October 19, the Stevens Center hosted an installment of the FinTech Lecture Series with Bloomberg’s Matt Levine in conversation with Professor Jeremy Siegel.

Matt Levine is a Bloomberg Opinion columnist who writes the daily Money Stuff newsletter. A former investment banker at Goldman Sachs, he was also previously a mergers and acquisitions lawyer at Wachtell Lipton, a clerk for the U.S. Court of Appeals for the 3rd Circuit an editor of Dealbreaker and a high school Latin teacher. Jeremy Siegel is the Russell E. Palmer Professor Emeritus of Finance at the Wharton School. He also serves as academic director of Wharton’s Securities Industry Institute and senior investment strategy advisor for WisdomTree Investments.

View photos from this lecture here.

From June 15-29, our Cypher Accelerator Manager, Khushi Shelat, led NYC Treehouse, a coworking space in New York designed to support women founders.

The pilot program ran in June in New York City with fireside chats and panels from executives in the technology space. The program positively impacted the broader startup community, and it plans to run future cohorts globally.

On December 9, 2021, Sarah Hammer hosted the Honorable Jay Clayton, former Chair of the U.S. Securities and Exchange Commission, and the Honorable Chris Giancarlo, former Chair of the Commodity Futures Trading Commission, for a fireside chat.

The event featured discussion of Mr. Clayton’s and Mr. Giancarlo’s time together leading national financial sector regulatory policy, as well as their thoughts on crypto policy and ongoing challenges and opportunities for the U.S. economy. Watch the fireside chat here (access passcode to view recording- g=q#?0in).

On November 30, 2021, Sarah Hammer hosted Mark Cuban for a fireside chat to promote Cypher Accelerator.

The event featured a discussion of evaluating start-up companies, venture capital, crypto, the future of education, and Mark’s first job selling garbage bags door to door. The lightning round chat covered Mark’s favorite dance while he was on Dancing with the Stars and his affinity for Iron Man. Watch the fireside chat here.

ON OCTOBER 18, 2021, THE STEVENS CENTER WAS PLEASED TO HOST THE HONORABLE J. CHRISTOPHER GIANCARLO AT THE PENN CLUB OF NEW YORK.

The event featured a fireside chat and party to celebrate the launch of his book, Crypto Dad: The Fight for the Future of Money. J. Christopher Giancarlo provides a dramatic, eyewitness view of his efforts during the Obama and Trump Administrations to modernize oversight of America’s antiquated financial markets.

ON SEPTEMBER 10, 2021, THE STEVENS CENTER HOSTED A RECEPTION FOR STUDENTS AND FACULTY TO WELCOME THEM BACK TO CAMPUS, INVITE THEM INTO THE NEW TANGEN HALL FACILITY, AND DISCUSS THE WORK OF THE CENTER.

The event featured a fireside chat with Arjun Kalsy of Polygon, which overviewed their work to build and connect Ethereum-compatible blockchain networks. Stevens Center research assistants raffled custom-designed “Ben on the Bench” non-fungible tokens and merch.

ON JUNE 30, 2021, SARAH HAMMER SERVED AS AN EXPERT WITNESS IN THE HOUSE FINANCIAL SERVICES SUBCOMMITTEE ON OVERSIGHT AND INVESTIGATIONS HEARING ON CRYPTOCURRENCY.

Ms. Hammer had the opportunity to testify about the importance of clarity and coordination (both domestic and international) in cryptocurrency regulation. She also shared her insights on investor protection and systemic risk. The hearing was broadcast on C-SPAN.

ON SEPTEMBER 21-27, 2020, THE STEVENS CENTER HOSTED A HACKATHON AND VIRTUAL CONFERENCE ON THE THEME OF COVID AND THE ECONOMY.

Wharton and Penn students came together to compete in a week-long hackathon aimed at identifying and analyzing data to understand the impact of the COVID-19 pandemic on the global economy and financial markets. The week featured keynote discussions with leaders from finance, blockchain, academia, and public policy. See winning paper here.

On October 10-11, 2019, the Stevens Center hosted the Wharton Institutional Crypto CEO Forum, an invitation-only executive forum on cryptocurrency.

This private event featured discussions on regulation, exchanges, institutional execution, market-making, and payments. The event brought together investors, executives, regulators, and thought leaders in the crypto space. The event agenda can be found here.

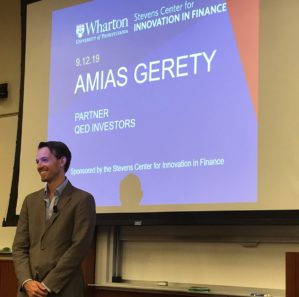

On September 12, 2019, the Stevens Center held a fall speaker event with Amias Gerety, Partner at QED Investors.

At this event, Mr. Gerety shared his knowledge as a venture investor focused on office technologies and financial infrastructure companies. Mr. Gerety also shared his insight as former Acting Assistant Secretary for Financial Institutions at the U.S. Department of Treasury, where he was lead advisor to the Treasury Secretary on financial institutions.

On Wednesday, April 3, 2019, former Dean Geoff Garrett and Ross Stevens, W’91, hosted the inaugural event for the Stevens Center for Innovation in Finance.

This roundtable, held in Jon M. Huntsman Hall, and moderated by Professor David Musto, included industry leaders from global fintech companies. President Amy Gutmann and former Dean Geoff Garrett delivered the introductory remarks. Featured panelists included included Robby Gutmann, CEO of New York Digital Investment Group (NYDIG), David Klein, CEO and co-founder of CommonBond, Jacqueline Reses, Head of Square Capital, and Elad Roisman, Commissioner of the U.S. Securities and Exchange Commission.