Sarah Hammer, Managing Director of the Stevens Center for Innovation in Finance at the Wharton School of the University of Pennsylvania

July 6, 2020

In these unprecedented times, the economic and financial markets impact of the coronavirus pandemic remains top of mind for us at the Wharton School. Over the last several months, the world has witnessed record levels of unemployment, falling corporate earnings, and significant dislocations in the financial markets. At the Stevens Center for Innovation in Finance, we strive to understand how technology and the digitization of finance may help support the global economy through this challenging period. Our work at the heart of financial technology and blockchain leads us to believe that innovation in finance can play a positive role in our transition through this difficult period and into a new world.

With this in mind, a team of dedicated students and graduates has been working to facilitate the launch of a blockchain-based data platform called MiPasa, to provide an open-source, integrated, collaborative approach to evaluating the economic and financial markets impacts of COVID-19. The first part of this work involved building an arsenal of information by combing through existing coronavirus-related data and normalizing it for analytical use, as well as creating unique data sets on topics where none previously existed. The team then systematically collected a series of economic and financial markets datasets that it believes will be key to understanding the short- and long- term effects of COVID-19 on the global landscape.

(chart: Rishin Sharma)

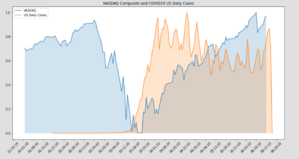

While there are many places to begin an analysis of the economic and financial markets impact of the pandemic, the most obvious and headline-grabbing place to start is the performance and volatility of stocks. Therefore, we begin with a 10,000 foot view of stock markets, comparing a 7-day rolling average of three major U.S. indices to newly documented cases of COVID-19 across the country. Not surprisingly, we found outperformance by the Nasdaq as compared to the S&P 500 and the Dow Jones Industrial Average. While this analysis was by no means scientific, the conclusions are certainly intuitive.

(chart: Rishin Sharma)

There are several possible reasons for outperformance of the Nasdaq as the world was hit by COVID-19. Many of the companies in the Nasdaq are technology-based, digital firms that can continue fundamental operations, and perhaps even thrive, during a pandemic. In terms of sector weightings, the Nasdaq is heavy in the information technology, communications services, and consumer discretionary sectors. The index also has some exposure to the healthcare sector and consumer staples, both of which are even more crucial during the current crisis. Importantly, the Nasdaq also has limited to no exposure to traditional financial companies and energy, both of which have performed poorly since the COVID-19 outbreak.

While these observations are interesting, it is important to note that the longer-term implications of a prolonged pandemic are yet to be seen. Technology companies may have fared better than others over the past several months, but they are not immune to the challenges of COVID-19 or future virus outbreaks. For example, in late April, Apple announced that they would not provide revenue guidance to investors for the first time since 2003. Primarily, this was because iPhone supplies were significantly affected by the health situation in China. In addition, although Amazon’s revenue grew 26% during the first three months of 2020, CEO Jeff Bezos announced that Amazon would spend the entirety of its $4 billion profit on COVID-related expenses between April and June.

The ultimate point is that analysis of COVID and the economy is highly complex, and there is much more work to be done. Towards that end, our team will be exploring economic and financial markets topics that include the impact of lockdowns on consumer spending and payments, the performance of technology-based versus traditional financial services companies, the parsing of jobless claims and unemployment data across states, global and regional economic growth comparisons, and the role of COVID-19 testing. We will also be leading a hackathon to further analyze these issues, and welcoming the input of data scientists and programmers from around the world. Throughout our work, we welcome analysis and input from others. By working together, in a collaborative and integrated fashion, we can move forward, and ultimately out of, this pandemic.